Effect of Covid-19 on Social Security Benefits

Published: 12/1/2020

Reddit user jgatcomb started an interesting thread about the impact of Covid-19 on Social Security recipients born in 1960 . In it, jgatcomb referred to a morningstar article suggesting that those born in 1960 will potentially have their benefits permanently reduced by 9.1%. How true is this? Let's use the SSA.Tools calculator to understand this better.

We want to simulate a earner who:

- Has 35 years of average earnings records.

- Their last record will be 2020.

- They were born in 1960.

I've created a data file with exactly this setup. You can try it for yourself by copying the entire file at covidpaste.txt and then pasting it in to the text box on the SSA.tools Calculator. After doing so, select a birthday in 1960, but not Jan 1, because with Social Security law, you attain an age the day before your standard birthday.

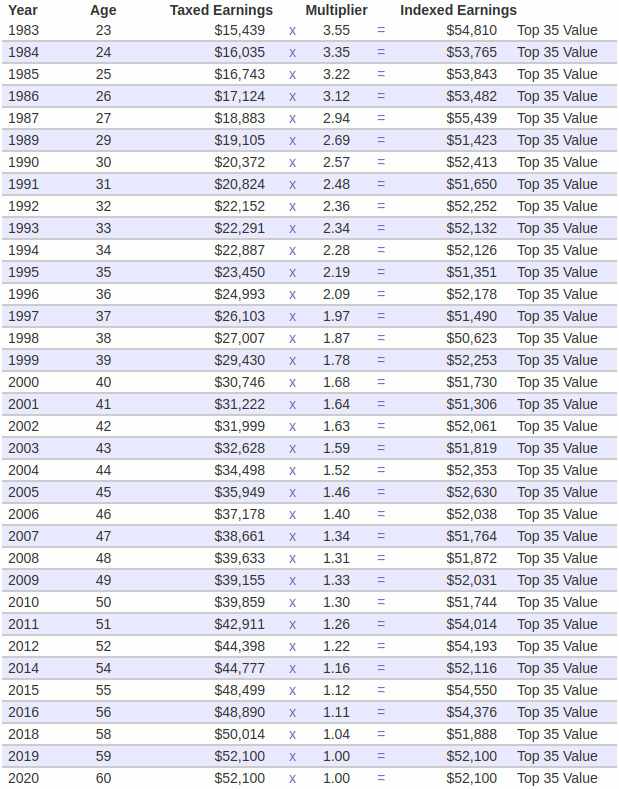

The resulting earnings table will look like this:

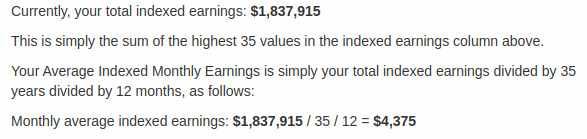

From this table, Social Security will calculate your AIME or Average Indexed Monthly Earnings. If you have 35 vaules, it's really just the average of all of the values in the "Indexed Earnings" column divided by 12 to get from annual to monthly. The calculation is a little further down the page:

At this point, we can start to think about how Covid-19 might affect the AIME calculation for this 1960-born earner. The key is the "Multiplier" collumn in the earnings table. The ssa.tools calculator doesn't currently explain where these multipliers come from, since the user has no control over them, but I will attempt to do so now.

These multipliers are only estimates until a person turns 62. In the year one turns 62, the final multipliers are calculated for all years up to and including age 60. All later years, the multiplier will always be 1.0. For the years up to and including age 60, the multipler for a given year will be the Average Wage Index (AWI) in the year you turned 60 divided by the AWI of the multiplier year. So, for someone who turns 60 in year 2020:

| Multiplier (year X) = | AWI (year 2020) |

| AWI (year X) |

We can then multiply this by Taxed Earnings to see how AWI affects the Indexed Earnings in each year:

| Indexed Earnings (year X) = | Taxed Earnings (year X) x AWI (year 2020) |

| AWI (year X) |

We can also see why calculations are made 2-years "late". The AWI for a given year is not known until taxes are filed the following year. So the AWI for 2020 won't be known until late in 2021. By the start of 2022, we will know the AWI correctly.

Typically multipliers only increase every year, because typically AWI only increases every year, but this is not guaranteed. In fact, you can see the 2008 multiplier is slightly lower than the 2009 multiplier (1.31 vs 1.33) because of the 2008 recession.

How does Covid-19 factor into this? If the AWI (year 2020) is reduced by 9.1% for example, then every Indexed Earnings value is also reduced by 9.1%. If every Indexed Earnings value is reduced by 9.1%, then the AIME is also reduced by 9.1% since it is just an average of the top 35 years of Indexed Earnings values.

The morningstar article suggest that AWI could be 9.1% less than expected (or 5.9% less than 2019 depending on what you are comparing it to). This is based on the Social Security Trustees report, so it is probably a good estimate.

The number one really cares about is the Primary Insurance Amount (PIA), not AIME, since PIA is the number that benefits are based on. However, since the bend points in the PIA formula are also adjusted by AWI, the effect on PIA is also very close to the same as on AIME. The calculator provides no easy means for manually modifying bend points to demonstrate easily, but we can do so manually for this example.

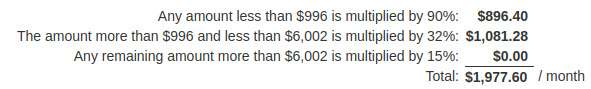

First, let's see what the calculator predicts as the PIA if there was not a covid related drop:

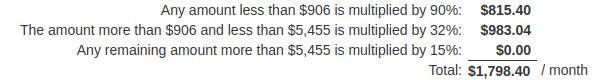

Next, adjust both the AIME and the bendpoints downward by 9.1%:

Going from $1,977.60 to $1,798.40 is a 9.06% drop, very similar to the 9.1% number we started with. In conclusion, a significant drop in AWI in a single year can have an similarly outsized effect on the Social Security benefits for those who turn 60 in that year. In the history of the Social Security program, there has not been such a dramatic drop in AWI from one year to the next like Covid appears to have produced, so this has never been much of an issue until now.