How Government Shutdowns Affect Social Security

Published: 9/30/2025

The bottom line: Government shutdowns never stop Social Security benefit payments. The system has never missed a payment in its 90-year history. However, shutdowns severely disrupt the services that help Americans apply for benefits, resolve problems, and access basic assistance. Understanding the difference between payment continuity and service availability is crucial for navigating shutdown periods.

Current Shutdown Threat and Context

As the federal fiscal year ends at midnight tonight (September 30, 2025), the GOP-led Congress has failed to reach agreement on funding legislation, making a government shutdown imminent. Both Republican and Democratic funding bills failed to reach the required 60 votes in the Senate, and the shutdown will proceed at midnight Eastern Time. This would be the first federal shutdown in six years, despite the Republican Party controlling the presidency, House, and Senate. This highlights the deep disagreements within the GOP that have prevented passage of either a full-year budget or a continuing resolution.

This situation occurs amid ongoing challenges at the Social Security Administration. Earlier in 2025, the agency underwent significant administrative changes that reduced staffing by approximately 7,000 employees (12% of the workforce). These existing capacity constraints mean a shutdown would compound already-strained services.

The combination of reduced baseline staffing from the 2025 administrative changes and potential shutdown furloughs could create unprecedented service disruptions, even though benefit payments would continue uninterrupted.

Why Social Security Payments Always Continue

Social Security operates fundamentally differently from most government programs. Your retirement and disability benefits are funded by dedicated payroll taxes flowing into trust funds, completely separate from the annual budget battles that trigger shutdowns. Here's how the protection works:

- Permanent Funding Authorization: Congress authorized Social Security payments in perpetuity when it created the program, not year-by-year through annual budgets.

- Dedicated Trust Funds: The Old-Age and Survivors Insurance Trust Fund and Disability Insurance Trust Fund collected $1.35 trillion in 2023 from payroll taxes that continue flowing during shutdowns.

- Automatic Redemption: The trust funds hold $2.79 trillion in Treasury securities that can be automatically redeemed to fund benefits without Congressional action.

Supplemental Security Income (SSI) presents a technical difference: it's funded from general Treasury revenues rather than payroll taxes. However, SSA's budget documents indicate SSI can continue for up to three months during shutdowns using previously appropriated funds, providing adequate protection since the longest shutdown in history was 35 days in 2018-2019.

What Services Stop During Shutdowns

While payments continue, the administrative machinery supporting Social Security faces severe curtailment. SSA typically furloughs about 12% of its workforce while retaining 88% as "excepted" employees who work without immediate pay. However, this understates the service impact because retained employees focus exclusively on payment-critical activities.

Services That Completely Stop

- Social Security Card Issuance: New and replacement Social Security cards become unavailable

- Benefit Verifications: Official proof of benefits needed for housing, loans, and other applications

- Earnings Record Corrections: Updates to your work history unrelated to current benefit processing

- Overpayment Processing: Resolution of benefit overpayment issues

- Freedom of Information Act Requests: All FOIA processing suspends

- General Customer Service: Non-critical inquiries and assistance

Services That Continue With Severe Delays

- New Benefit Applications: Initial retirement and disability claims continue being accepted but with dramatically reduced processing capacity

- Phone Service: The 1-800 number remains operational but with wait times extending from the typical long wait times to potentially 3-4 hours or more

- Field Office Visits: Offices stay open but operate with skeleton crews, creating extremely long wait times for in-person service

- Online Services: The my Social Security portal continues functioning for submissions, but backend processing slows dramatically

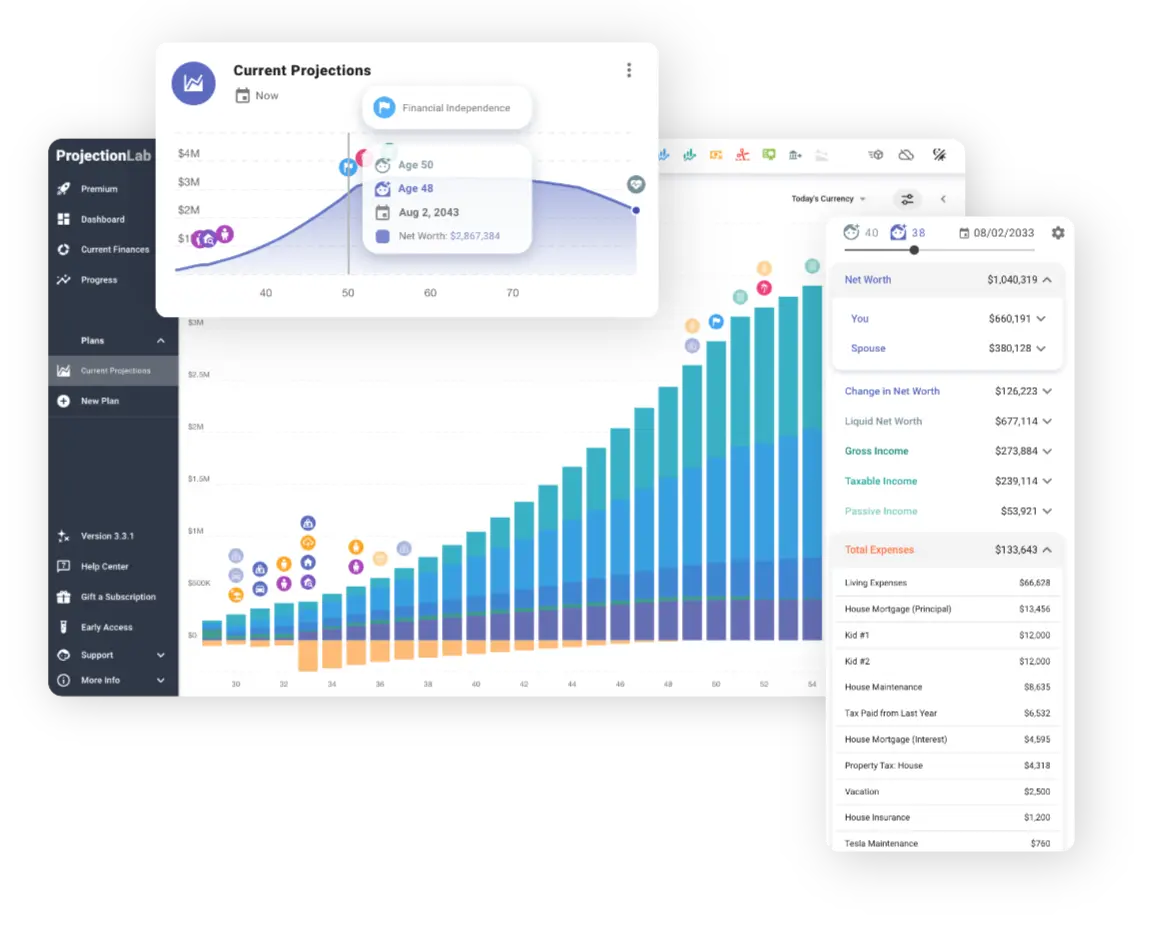

ProjectionLab

Sponsor

ProjectionLab Sponsor

Already optimizing your Social Security? Take your retirement planning to the next level with ProjectionLab, the comprehensive financial modeling platform trusted by serious planners.

- Monte Carlo simulations: Run thousands of market scenarios using 150+ years of historical data to stress-test your plan.

- Advanced modeling: Model complex strategies including Roth conversions, tax-loss harvesting, and dynamic withdrawal rates.

- Professional-grade analytics: Analyze success probabilities, sequence of returns risk, and optimal asset allocation across market cycles.

Disability Claims Face Unique Challenges

Disability benefit processing reveals shutdowns' most complex impacts. While SSA continues accepting applications and processing the most urgent cases (terminally ill individuals, wounded warriors, dire need situations), a critical bottleneck emerges at State Disability Determination Services.

These state offices, funded by federal dollars, make the medical determinations that decide disability claims. SSA cannot mandate they continue operations during shutdowns. It can only "encourage" continued service with promises of reimbursement after funding resumes. During the 2013 shutdown, nine states furloughed all DDS employees while three furloughed some, creating a 14% capacity shortfall and severe geographic disparities.

Administrative Law Judge hearings continue with limited support. While hearings proceed, decisions aren't written during shutdowns, meaning even successful claimants face additional delays in receiving benefits.

Historical Impact: Learning from Past Shutdowns

Past shutdowns provide concrete data on Social Security impacts:

2013 Shutdown (16 days)

- SSA accumulated 150,000 employee furlough days

- Over 1,600 medical disability reviews delayed daily

- Over 10,000 SSI redeterminations postponed daily

- Approximately 960,000 Social Security card applications accumulated during the 16-day period

- 1.2 million income verification requests for mortgages and loans were delayed

1995-1996 Shutdowns (5 days + 21 days)

- First shutdown: 800,000 federal employees furloughed for 5 days

- Second shutdown: 284,000 employees furloughed for 21 days

- Significant disruptions to government services and tourism

Recovery takes 3-5 times the shutdown duration. A three-week shutdown typically requires 9-15 weeks to clear accumulated backlogs and restore normal service levels.

Practical Steps to Protect Yourself

Before a Shutdown

- Set Up Online Access: Create your my Social Security account now if you haven't already

- Download Current Documents: Print or save copies of benefit statements, payment history, and any verification letters you might need

- Complete Pending Business: Handle any Social Security matters requiring human assistance before a shutdown begins

- Update Direct Deposit: Ensure your bank account information is current and verify your payment schedule

During a Shutdown

- Monitor Your Payments: Benefits continue, but watch your account to confirm deposits arrive as scheduled

- Avoid Non-Critical Requests: Postpone routine inquiries, earnings corrections, and card replacements if possible

- Use Online Services First: Try online options before calling or visiting offices

- Plan for Delays: If you must conduct business, expect significantly longer wait times

- Keep Documentation: Save confirmations, reference numbers, and notes from any interactions

For Urgent Situations

If you face truly urgent Social Security matters during a shutdown:

- Contact Your Congressional Representative: Congressional offices often have dedicated staff to help constituents with federal benefit issues

- Emphasize Urgency: Clearly explain time-sensitive circumstances like imminent eviction, medical emergencies, or loss of other benefits

- Seek Legal Assistance: Community legal aid organizations may provide guidance during extended shutdowns

Medicare and Other SSA Functions

Medicare benefits also continue during shutdowns through similar trust fund protections. Hospital insurance (Part A) draws from the Hospital Insurance Trust Fund, while physician services (Part B) and prescription drugs (Part D) continue through their funding mechanisms. However, Medicare card replacement becomes unavailable except through online portals.

Other SSA functions face varying impacts:

- Representative Payee Services: Limited to emergency situations only during shutdowns

- Program Integrity Work: Reviews to prevent fraud and improper payments largely suspend, allowing questionable cases to continue unchecked

- Appeals Processing: Administrative appeals beyond ALJ hearings face significant delays

Long-term Implications

Extended shutdowns create consequences lasting months or years beyond the funding gap itself:

- Workforce Attrition: Employees leave federal service during and after shutdowns, creating permanent knowledge and capacity loss

- Technology Debt: IT modernization and system maintenance postponed during shutdowns accumulate, increasing long-term operational risks

- Disability Backlog Growth: The existing disability claims backlog grows larger and takes longer to resolve

- Program Integrity Gaps: Suspended fraud detection and prevention work during shutdowns allows improper payments that continue indefinitely

Key Takeaways

Government shutdowns create a critical distinction between Social Security's payment function and its service function. Your monthly benefits will arrive on schedule, but accessing help, resolving problems, or conducting new business becomes dramatically more difficult.

The current political context (one party controlling all branches of government yet unable to fund operations), combined with the SSA's already-reduced workforce from 2025's administrative changes, threatens unprecedented service disruptions. While the fundamental promise of Social Security remains secure, the systems supporting beneficiaries face serious challenges.

Understanding these realities helps you prepare appropriately: handle routine business before shutdowns begin, set up online access for self-service options, and know where to seek help for truly urgent situations. Most importantly, remember that while services may be disrupted, your benefits themselves remain protected by law and decades of precedent.