The New Senior Tax Deduction

Published: 2/2/2026

During the 2024 campaign, a prominent promise was "no tax on Social Security." The legislative result, passed as part of the One Big Beautiful Bill (OBBB) Act, is not an exemption from Social Security taxation but rather a new additional standard deduction for seniors age 65 and older. While it doesn't change the rules for how Social Security benefits are taxed, it can meaningfully reduce the federal tax bill for many retirees.

Key Takeaways

- New deduction of $6,000 per eligible individual (2025-2028)

- Must be age 65+ with a valid SSN

- Income phase-out begins at $75,000 single / $150,000 joint (MAGI)

- Stacks on top of the existing standard deduction and senior addition

- Does not change the provisional income formula for taxing Social Security

- Temporary: expires after the 2028 tax year

Who Qualifies

To claim the new senior tax deduction, you must meet all of these:

- Age 65 or older by the end of the tax year (the same rule used for the existing additional standard deduction for seniors)

- Provide a valid Social Security number

- If married, you must file a joint return (married filing separately does not qualify)

Deduction Amount

| Tax Year | Per Person | Joint (Both 65+) |

|---|---|---|

| 2025-2028 | $6,000 | $12,000 |

If only one spouse in a joint return is 65 or older, the couple receives half the joint amount ($6,000 instead of $12,000).

Income Phase-Outs

The deduction is reduced for higher-income filers based on modified adjusted gross income (MAGI). It phases out by $60 for every $1,000 of MAGI above the threshold.

| Filing Status | Phase-Out Begins | Fully Phased Out |

|---|---|---|

| Single | $75,000 | $175,000 |

| Married Filing Jointly | $150,000 | $250,000 |

Phase-Out Example

Carol is single, age 68, with a MAGI of $95,000 in 2026. Her MAGI is $20,000 over the $75,000 threshold.

- Reduction: 20 x $60 = $1,200

- Deduction: $6,000 - $1,200 = $4,800

ProjectionLab

Sponsor

ProjectionLab Sponsor

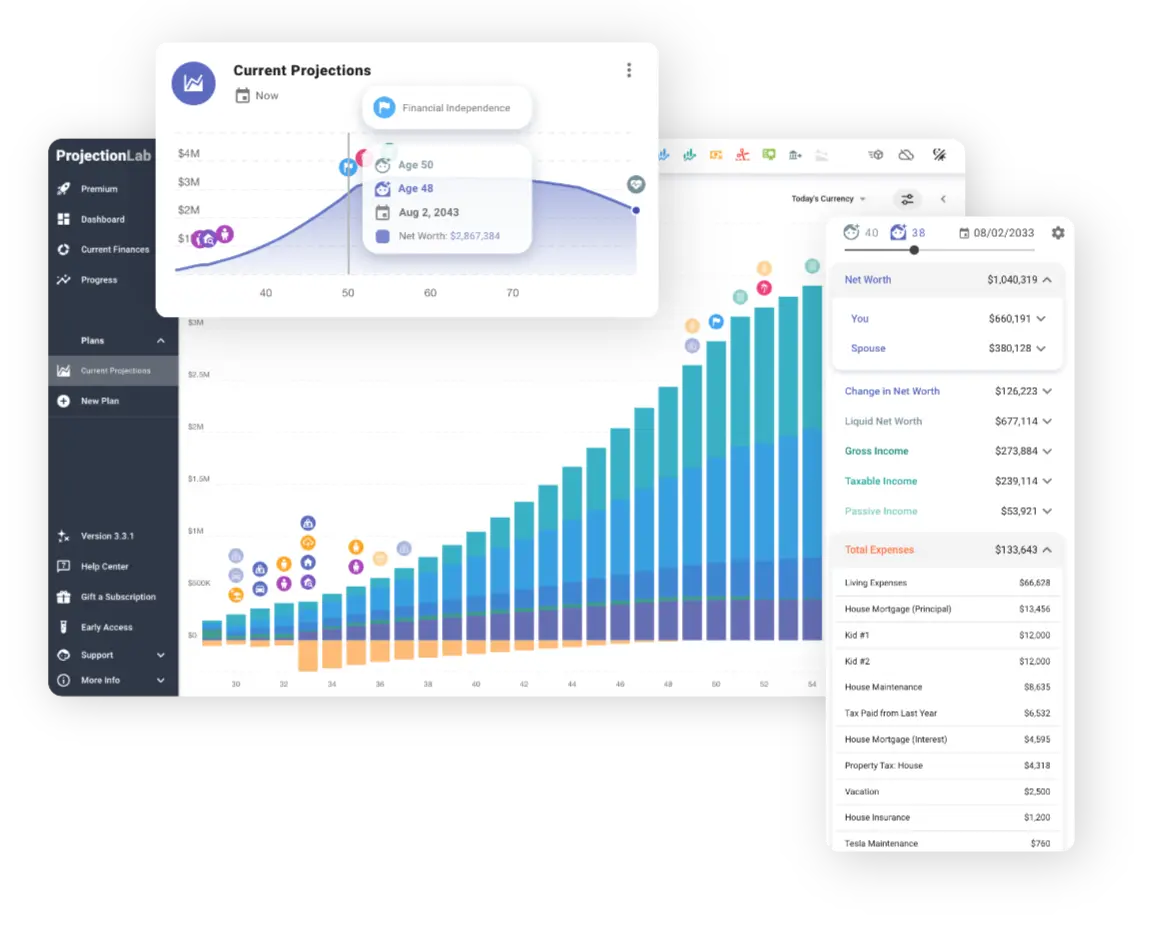

Already optimizing your Social Security? Take your retirement planning to the next level with ProjectionLab, the comprehensive financial modeling platform trusted by serious planners.

- Monte Carlo simulations: Run thousands of market scenarios using 150+ years of historical data to stress-test your plan.

- Advanced modeling: Model complex strategies including Roth conversions, tax-loss harvesting, and dynamic withdrawal rates.

- Professional-grade analytics: Analyze success probabilities, sequence of returns risk, and optimal asset allocation across market cycles.

How It Stacks with Existing Deductions

The new senior tax deduction is in addition to both the regular standard deduction and the existing additional standard deduction for taxpayers 65 and older. It does not replace either.

Example: Single Filer, Age 67, Tax Year 2026

- Standard deduction (2026, estimated): ~$16,150

- Existing additional senior deduction: ~$2,000

- New OBBB senior deduction: $6,000

- Total deduction: ~$24,150

This means a single senior with gross income at or below roughly $24,150 would owe zero federal income tax.

Example: Married Filing Jointly, Both Age 66, Tax Year 2026

- Standard deduction (2026, estimated): ~$32,300

- Existing additional senior deduction (x2): ~$3,200

- New OBBB senior deduction (x2): $12,000

- Total deduction: ~$47,500

Impact on Social Security Benefit Taxation

It is important to understand what this deduction does not do: it does not change the provisional income formula that determines how much of your Social Security benefits are taxable. Up to 85% of benefits can still be included in taxable income under the same rules that have been in place since 1993.

What the deduction does do is reduce your overall taxable income after the provisional income calculation. This means:

- Your provisional income (AGI + tax-exempt interest + half of Social Security) is calculated the same way as before

- The taxable portion of Social Security is determined the same way as before

- The new deduction then reduces your taxable income, potentially to zero

Example: How the Deduction Affects a Retiree's Taxes

Bob is single, age 68, in 2026. He has $20,000 in Social Security benefits and $15,000 in pension income.

- Provisional income: $15,000 + ($20,000 / 2) = $25,000

- Taxable Social Security: $0 (provisional income at or below $25,000 threshold for single filers)

- AGI: $15,000

- Total deductions: ~$24,150 (standard + senior + new OBBB)

- Taxable income: $0

- Federal tax owed: $0

Planning Strategies

The income phase-outs create planning opportunities for retirees who are near the thresholds:

Roth Conversions

Converting traditional IRA funds to a Roth IRA increases your MAGI in the year of conversion. If you plan to do Roth conversions, consider keeping your total MAGI below the phase-out thresholds to preserve the full deduction. Alternatively, do larger conversions in years when you wouldn't qualify for the deduction anyway.

RMD Timing

Required minimum distributions (RMDs) from traditional retirement accounts count toward MAGI. If you turned 73 and have flexibility in when you take your first RMD, consider the impact on the senior deduction phase-out.

Tax-Deferred Contributions

If you are still working at age 65+, contributions to a traditional 401(k) or traditional IRA reduce your MAGI, potentially keeping you below the phase-out thresholds.

Capital Gains Management

Realized capital gains increase MAGI. Consider spreading asset sales across multiple years or using tax-loss harvesting to manage your income relative to the phase-out thresholds.

This Is a Temporary Provision

Frequently Asked Questions

Does the new senior tax deduction eliminate taxes on Social Security?

Not directly. The deduction does not change how Social Security benefits are taxed. However, by reducing your taxable income, it may lower or eliminate the amount of federal tax you owe on those benefits. For retirees with modest incomes, the deduction may effectively result in zero federal tax on Social Security.

How much is the new senior tax deduction?

The deduction is $6,000 per eligible individual for tax years 2025 through 2028. A married couple filing jointly where both spouses are 65 or older can deduct up to $12,000.

Who qualifies for the senior tax deduction?

You must be age 65 or older by the end of the tax year, provide a valid Social Security number, and if married, you must file a joint return. The deduction phases out for higher-income filers: beginning at $75,000 MAGI for single filers and $150,000 for joint filers.

Is the senior tax deduction permanent?

No. The deduction applies only to tax years 2025 through 2028. Unless Congress extends it, the provision expires after the 2028 tax year.

Can I take the new senior tax deduction along with the existing senior standard deduction?

Yes. The new deduction stacks on top of both the regular standard deduction and the existing additional standard deduction for taxpayers age 65 and older. For example, a single filer age 65+ in 2026 could receive the standard deduction plus the existing senior addition plus the new $6,000 senior deduction.

What is the income phase-out for the senior tax deduction?

The deduction phases out by $60 for every $1,000 of modified adjusted gross income (MAGI) above $75,000 for single filers or $150,000 for joint filers. It is fully phased out at $175,000 for single filers and $250,000 for joint filers.

Learn More

For the official IRS guidance on this provision, see the IRS newsroom announcement.

For a detailed explanation of how Social Security benefits are taxed federally, including the provisional income formula, see our Federal Taxation of Social Security Benefits guide. For information about working while receiving benefits, see our Earnings Test guide.

Use the SSA.tools calculator to estimate your Social Security benefits based on your earnings history.