Spousal Benefits and Filing Dates: A Deep Dive

Published: 9/6/2023

Key Points

- Spousal benefit = 50% of spouse's PIA — not 50% of their actual benefit

- Early filing penalty is higher — 8.33%/year for first 3 years vs 6.67% for personal benefits

- No delayed credits — spousal benefits don't increase for filing after FRA

- Filing dates interact — both spouses' filing ages affect the final amounts

The Basics: What is a Spousal Benefit?

A spousal benefit is the benefit a person can receive based on their spouse's earning record. In the simplest case, this can be half of the spouse's Primary Insurance Amount (PIA).

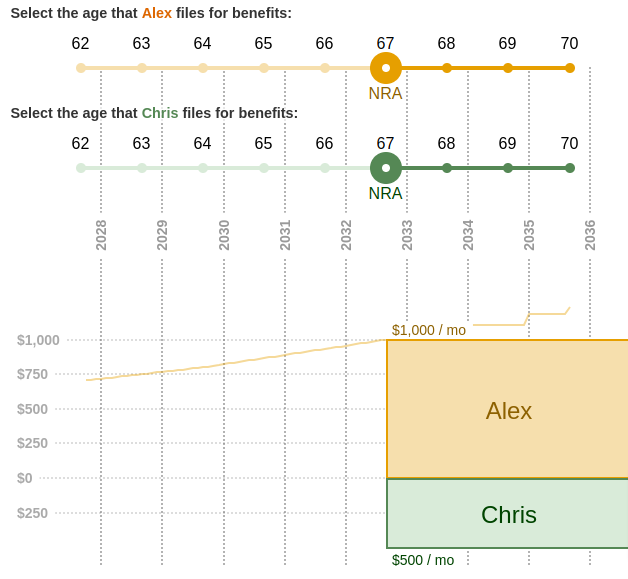

For example, if:

- Alex has a $1,000/mo Primary Insurance Amount

- Chris has no earnings

- Alex and Chris both file for benefits at Full Retirement Age

In this situation, Chris will receive a spousal benefit of $500/mo.

You can explore this example with this calculator link.

SSA.tools

Free Calculator

SSA.tools Free Calculator

See how this applies to your benefits. Use the free SSA.tools calculator with your actual earnings record for personalized results.

- Copy & paste: Import your earnings record directly from SSA.gov in seconds.

- What-if scenarios: Explore how different filing ages and future earnings affect your benefit.

- 100% private: Your data never leaves your browser — nothing is stored or transmitted.

How Filing Age Affects Spousal Benefits

Early Filing

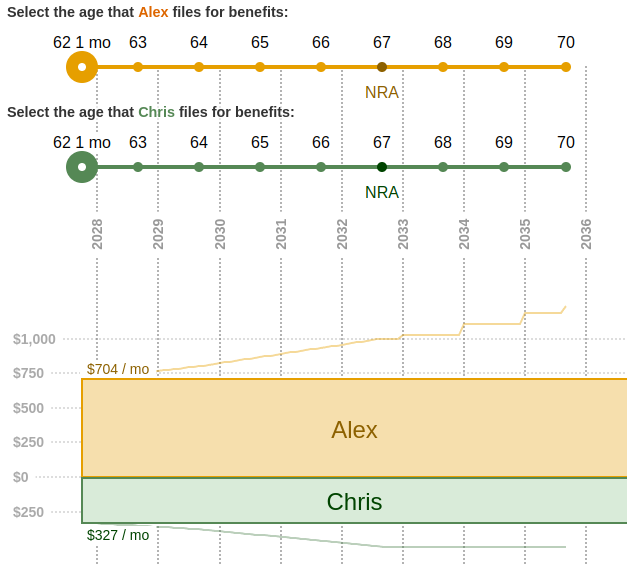

What would happen instead if Alex and Chris filed earlier than Full Retirement Age, such as at age 62 and 1 month?

In this case, Alex would receive a reduced benefit of $704/mo, and Chris would receive a reduced spousal benefit of $327/mo.

Notice that Chris's benefit is no longer half of Alex's benefit. This is because the reduction formulas are different:

- Personal benefits: reduced 6.67% for the first 3 years, 5% for each additional year filed early

- Spousal benefits: reduced 8.33% for the first 3 years, 5% for each additional year filed early

There is a larger penalty for early filing for spousal benefits than for personal benefits.

Late Filing

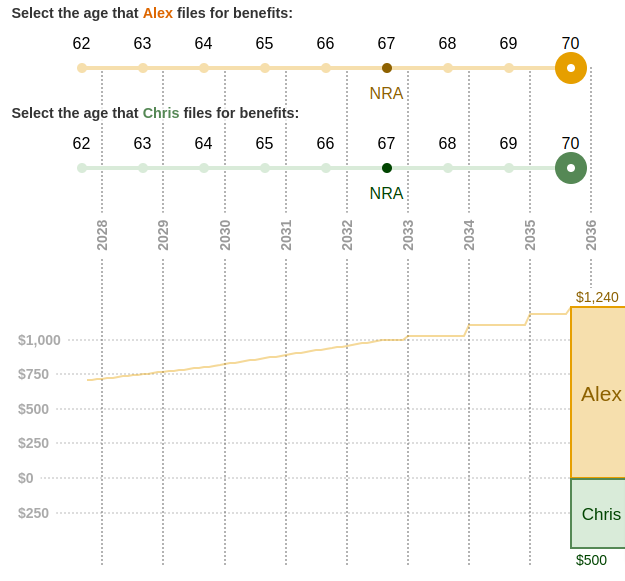

What would happen instead if Alex and Chris filed later than Full Retirement Age, such as at age 70?

Alex's benefit would be increased by 8% for each year filed late, making the final benefit $1,240/mo.

However, Chris's spousal benefit would remain at $500/mo. Unlike personal benefits, spousal benefits do not increase from delayed retirement credits for filing after Full Retirement Age.

When Both Spouses Have Earnings

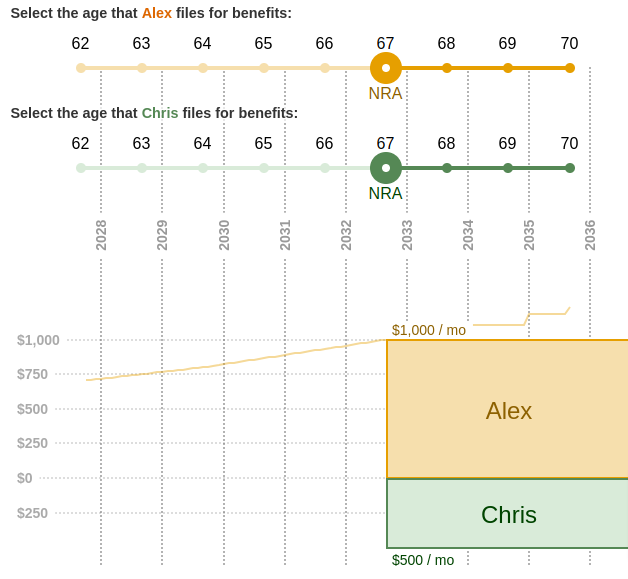

Filing at Full Retirement Age

In all of the above examples, the lower earning spouse (Chris) has $0 in earnings. What happens if Chris has earnings of their own?

Let's imagine that Chris also has a $100/mo personal benefit. This is small enough relative to Alex's benefit that Chris still qualifies for a spousal benefit.

You can use this link to explore the scenario.

If Alex and Chris both file at Full Retirement Age, Chris's total benefit is still $500/mo, which is $100/mo from their own benefit and $400/mo from the spousal benefit.

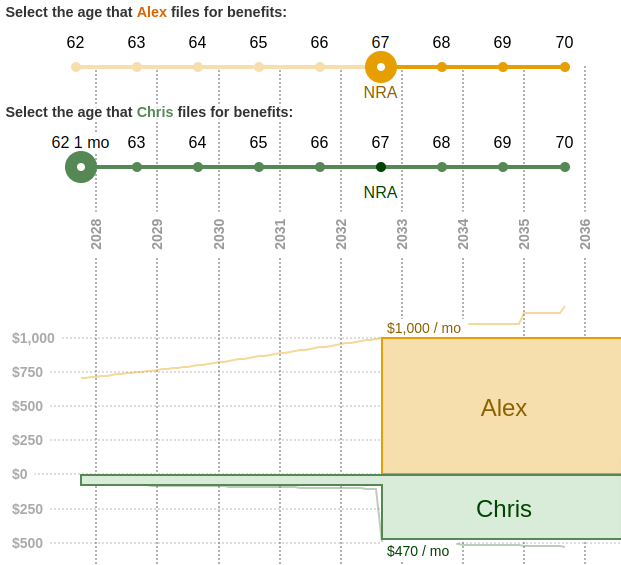

When Chris Files Early

What happens if Chris files early at age 62 and 1 month?

Chris's personal benefit is reduced to $70/mo due to filing early. However, Chris's spousal benefit is not reduced because that component didn't start until Chris's Full Retirement Age at 67 (when Alex filed).

If Alex had filed earlier as well, Chris's spousal benefit would have been reduced also.

Here we can see where the concept of the spousal benefit being half of the higher earning spouse's benefit breaks down. In this case, Chris's spousal component is $400/mo, not $500/mo, because Chris receives $70/mo from their own reduced benefit plus $400/mo spousal = $470/mo total.

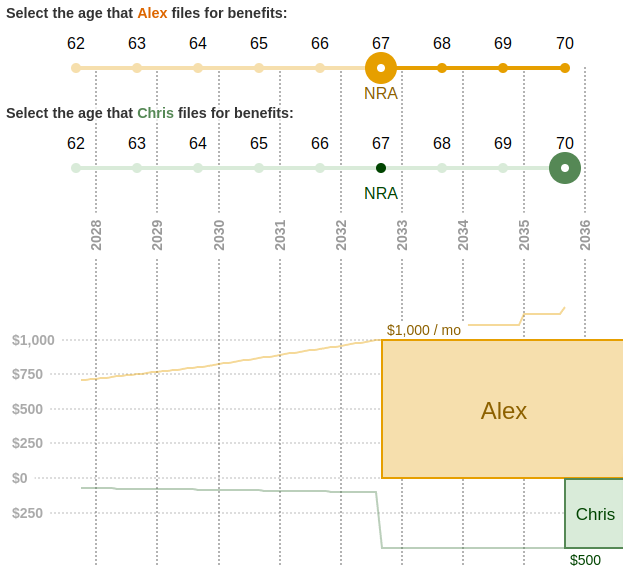

When Chris Files Late

What happens if Chris files late at age 70?

Chris's personal benefit is increased to $124/mo due to delayed retirement credits.

However, the spousal benefit cannot increase the combined benefit for Chris to an amount greater than half of Alex's PIA. So, the spousal benefit is reduced by $24/mo to $376/mo to keep the total benefit at $500/mo. (SSA reference)

The resulting total is $500/mo: $124/mo from Chris's personal benefit and $376/mo from the spousal benefit.

Does the Primary Earner's Filing Date Matter?

Is Chris's spousal benefit amount affected by when Alex files?

No. The spousal benefit is based on Alex's Primary Insurance Amount, not their actual benefit amount. So, in this scenario, Chris's spousal benefit is always based on $1,000/mo (Alex's PIA), regardless of when Alex files.

However, Chris cannot file for spousal benefits until Alex has filed for their own benefits. So, in some sense, Alex's filing date does affect Chris's spousal benefit because it determines when Chris can begin receiving spousal benefits.

Exception: Divorced Spouses

In the case of divorced couples where one is eligible for benefits on an ex-spouse's record, the filing date of the primary earner does not affect the spousal benefit amount. If you were married for at least 10 years and are now divorced, see our divorced spouse benefits guide for the complete eligibility rules, including how to claim even if your ex hasn't filed yet.

Related Guides

- Primary Insurance Amount (PIA) — The foundation for all spousal benefit calculations

- AIME Guide — How earnings are averaged to determine your PIA

- Maximum Benefit — The highest possible spousal benefit comes from a spouse with maximum PIA

- Work Credits — Spousal benefits don't require you to have earned any credits

- Divorced Spouse Benefits — Special rules for claiming benefits from an ex-spouse after divorce

- Survivor Benefits — If your spouse passes away, survivor benefits can be up to 100% (vs. 50% for spousal)

- Filing Date Chart Guide — How to read the interactive chart showing combined benefits for couples

Try It Yourself

Use the SSA.tools calculator to explore how different filing dates affect spousal benefits for your specific situation.