Windfall Elimination Provision (WEP): What It Was and Why It No Longer Applies

Published: 1/16/2026

Why was my Social Security lower than expected? For 42 years, the answer for millions of teachers, firefighters, police officers, and other public servants was the Windfall Elimination Provision (WEP). This rule reduced Social Security benefits for anyone with a pension from employment not covered by Social Security, a so-called "non-covered pension."

On January 5, 2025, President Biden signed the Social Security Fairness Act, repealing both WEP and its companion provision, the Government Pension Offset (GPO). This guide explains what WEP was, who it affected, and what the repeal means for you.

Was WEP Repealed?

Yes, WEP was repealed. The Social Security Fairness Act (H.R. 82) eliminated the Windfall Elimination Provision effective January 2024 (retroactively). The law was signed on January 5, 2025. WEP is no longer in effect, and the WEP reduction no longer applies to any Social Security beneficiary.

If you're searching for a "WEP calculator" to estimate your benefit reduction, you no longer need one. Your Social Security benefits are now calculated using the standard formula that applies to all workers.

What Was the Windfall Elimination Provision?

The WEP was enacted as part of the Social Security Amendments of 1983, signed by President Reagan. Congress designed it to address what it viewed as an unintended flaw in the benefit formula.

Social Security's formula is deliberately progressive, using a tiered system based on your Averaged Indexed Monthly Earnings (AIME):

- 90% of the first bracket of AIME (for lower earners)

- 32% of the second bracket

- 15% of earnings above that

The problem arose when workers split careers between jobs covered by Social Security and jobs that were not covered, such as state government positions with separate pension systems. Years in non-covered employment showed as zeros in their Social Security earnings records, making them appear to be low-wage workers entitled to the generous 90% replacement rate, even if their government salaries were substantial.

Congress considered this an unintended "windfall." The WEP solution reduced the first-bracket factor from 90% to as low as 40% for workers with fewer than 30 years of "substantial" Social Security-covered earnings.

The 30 Years of Substantial Earnings Rule

Workers with 30 or more years of substantial earnings under Social Security were always exempt from WEP. Their benefits were never reduced. "Substantial earnings" meant earning above a threshold amount that increased each year (about $31,275 in 2024).

Workers with 20 or fewer years of substantial covered employment faced the maximum WEP reduction, which reached $587 per month in 2024. Workers with 21-29 years received graduated relief:

| Years of Substantial Earnings | First Bracket Factor |

|---|---|

| 30 or more | 90% (no reduction) |

| 29 | 85% |

| 28 | 80% |

| 27 | 75% |

| 26 | 70% |

| 25 | 65% |

| 24 | 60% |

| 23 | 55% |

| 22 | 50% |

| 21 | 45% |

| 20 or fewer | 40% (maximum reduction) |

Who Was Affected by WEP?

WEP affected approximately 2.1 million beneficiaries at its peak, representing about 4% of all retired-worker beneficiaries. The provision targeted workers who received a non-covered pension (a pension from employment where they didn't pay Social Security taxes):

- Teachers with state pensions in 15 states (including California, Texas, Ohio, Massachusetts, and Illinois). The "teacher pension Social Security" problem was one of the most common WEP scenarios.

- State and local government employees in 26 states with separate pension systems

- Federal employees hired before January 1, 1984, under the Civil Service Retirement System (CSRS). The CSRS pension triggered WEP for these workers.

- Police officers and firefighters in many jurisdictions

- Workers with foreign pensions. A foreign pension from non-covered employment could also trigger WEP.

- Some nonprofit workers in positions that opted out of Social Security

Contrary to common misconception, approximately 72% of state and local public employees worked in Social Security-covered positions and were never affected by WEP. The provision applied only to the roughly 6.5 million workers (about 28% of the public sector workforce) whose employers opted out of Social Security in favor of separate pension systems.

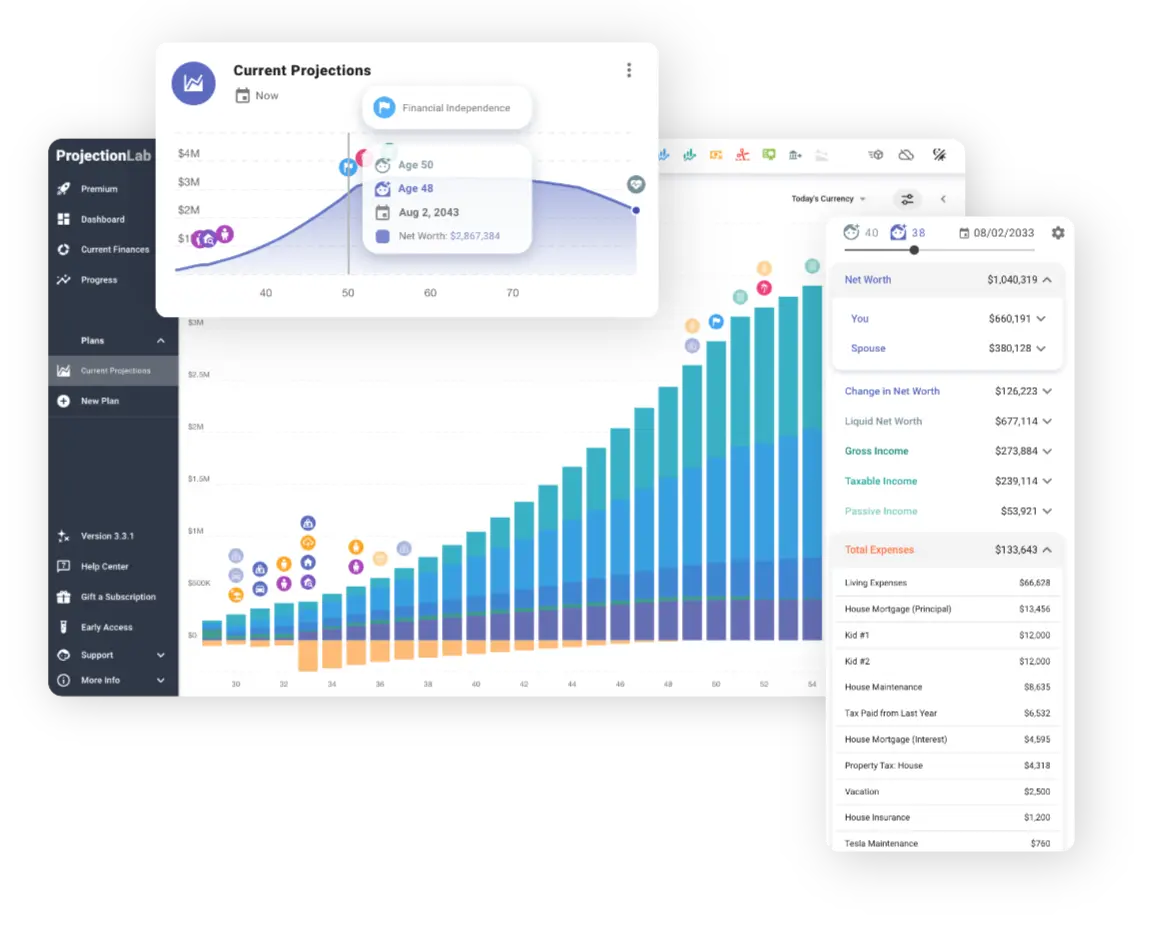

ProjectionLab

Sponsor

ProjectionLab Sponsor

Already optimizing your Social Security? Take your retirement planning to the next level with ProjectionLab, the comprehensive financial modeling platform trusted by serious planners.

- Monte Carlo simulations: Run thousands of market scenarios using 150+ years of historical data to stress-test your plan.

- Advanced modeling: Model complex strategies including Roth conversions, tax-loss harvesting, and dynamic withdrawal rates.

- Professional-grade analytics: Analyze success probabilities, sequence of returns risk, and optimal asset allocation across market cycles.

What's the Difference Between WEP and GPO?

Working alongside WEP was the Government Pension Offset (GPO), enacted even earlier in 1977. While WEP reduced a worker's own retirement benefits, GPO targeted spousal and survivor benefits, reducing them by two-thirds of the recipient's government pension.

The GPO's impact was often devastating. A widow receiving a $900 monthly government pension would see her Social Security survivor benefit reduced by $600. If her survivor benefit would have been $800, the GPO eliminated it entirely. By December 2023, 71% of those affected by GPO lost their entire Social Security spousal or survivor benefit.

The provision disproportionately affected women: 83% of the approximately 746,000 GPO-affected beneficiaries were female, many of them widows of workers who had paid into Social Security their entire careers.

Both WEP and GPO were repealed together by the Social Security Fairness Act.

The Social Security Fairness Act of 2025

After decades of advocacy, the Social Security Fairness Act (H.R. 82) finally passed with overwhelming bipartisan support:

- House vote (November 12, 2024): 327-75

- Senate vote (December 21, 2024): 76-20

- Signed into law: January 5, 2025

President Biden called it "a matter of honoring the promise that we made to public servants."

How Do I Get My WEP Money Back?

If you were already receiving reduced benefits due to WEP or GPO, you don't need to do anything. The Social Security Administration automatically recalculated benefits and issued retroactive lump-sum payments.

The SSA completed implementation five months ahead of schedule. By July 2025, the agency had processed over 3.1 million payments totaling $17 billion in retroactive benefits, covering the period from January 2024 (when the repeal took effect retroactively) through the implementation date.

The benefit increases varied based on individual circumstances:

| Beneficiary Type | Average Monthly Increase |

|---|---|

| WEP-affected workers | ~$360 |

| GPO-affected spouses | ~$700 |

| GPO-affected survivors | ~$1,190 |

For workers who faced the maximum WEP reduction, monthly benefits increased by $500-600 or more. Retroactive lump-sum payments typically amounted to several thousand dollars.

Why Critics Called WEP Unfair

Beyond the basic "windfall" rationale, WEP and GPO faced persistent criticism:

- Hidden impact: Annual Social Security statements showed projected benefits without accounting for WEP/GPO reductions, leaving workers shocked at retirement when their actual benefits were far lower than expected.

- Perverse incentives: Workers considering second careers in public service faced effective tax rates exceeding 100% on their Social Security contributions. They paid taxes into the system but received no additional benefits due to WEP.

- Double standard: Private sector workers with pensions faced no equivalent reduction. A corporate executive with both a 401(k) and Social Security received full benefits from both; a teacher with a state pension did not.

The Fiscal Trade-Off

The repeal came with a substantial price tag. The Congressional Budget Office estimated the 10-year cost at $195.7 billion. Critics warned the legislation would advance Social Security's projected insolvency date by approximately six months.

Advocates countered that the cost (roughly 1% of total Social Security expenditures over the period) was justified to correct decades of unfairness. They noted the provisions had already taken an estimated $60 billion from affected workers and their families.

What This Means for You Today

If you were previously affected by WEP or GPO:

- Already receiving benefits: Your monthly payment should already reflect the increased amount. The SSA automatically recalculated benefits and issued retroactive lump-sum payments.

- Haven't yet applied: You can now apply for benefits using the standard formula. There is no longer any WEP or GPO reduction.

- Using SSA.tools: The calculator shows your benefits using the standard PIA formula with no WEP adjustment, because WEP no longer exists.

Frequently Asked Questions

Is WEP still in effect?

No. WEP was repealed effective January 2024. The Windfall Elimination Provision no longer reduces anyone's Social Security benefits.

Do I need a WEP calculator?

No. Since WEP was repealed, there is no WEP reduction to calculate. You can use the standard SSA.tools calculator to estimate your benefits.

I have a teacher pension. Will my Social Security be reduced?

No. Before 2025, teachers in certain states with non-covered pensions had their Social Security reduced by WEP. This is no longer the case. Your teacher pension will not affect your Social Security calculation.

I have a CSRS pension. Does WEP apply to me?

No. Federal employees with Civil Service Retirement System (CSRS) pensions were previously subject to WEP, but the provision has been repealed. Your CSRS pension no longer affects your Social Security benefits.

I have a foreign pension. Am I affected by WEP?

No. Foreign pensions from non-covered employment previously triggered WEP, but since WEP was repealed, your foreign pension no longer affects your Social Security benefits.

Will I get back pay for WEP?

If you were already receiving benefits before the repeal, the SSA automatically sent retroactive payments covering January 2024 through mid-2025. Most affected beneficiaries received these payments by July 2025.

Calculate Your Benefits

Ready to see your Social Security benefits? Use the SSA.tools calculator to estimate your monthly payment. Simply paste your earnings record from ssa.gov, and the calculator will compute your Primary Insurance Amount using the standard formula, the same formula that now applies to everyone, including teachers, government employees, and anyone who previously would have been subject to WEP.