Will Social Security Run Out of Money?

Published: 8/11/2023

The Short Answer

- Social Security will not disappear — even if the trust fund is depleted, payroll taxes will continue funding benefits

- Current projection: 2034 — the trust fund surplus is expected to run out

- Worst case: 26% reduction — if nothing changes, benefits could be reduced by about 26%

- Congress has options — multiple legislative solutions exist to prevent or minimize cuts

Is Social Security Running Out of Money?

You may have heard that the Social Security program is running out of money. This is technically true, but only part of the story. Social Security is both paying out money to retirees and also collecting money from workers at the same time. Over its 80-year history, the program has collected more money than it has paid out. The current surplus is $3 trillion. However, in recent years the program is paying out more than it is collecting, and so the fund is shrinking. Current estimates are that the fund will run out in 2034.

What Happens When the Trust Fund Is Depleted?

Once the surplus runs out, the program will still be collecting money, and those collections will cover all but 26% of the current payments. So, if nothing changes by 2034, the calculated benefit may be reduced by 26%, but the payments will still continue. This is probably the "worst case" scenario.

More information: The Future Financial Status of the Social Security Program

ProjectionLab

Sponsor

ProjectionLab Sponsor

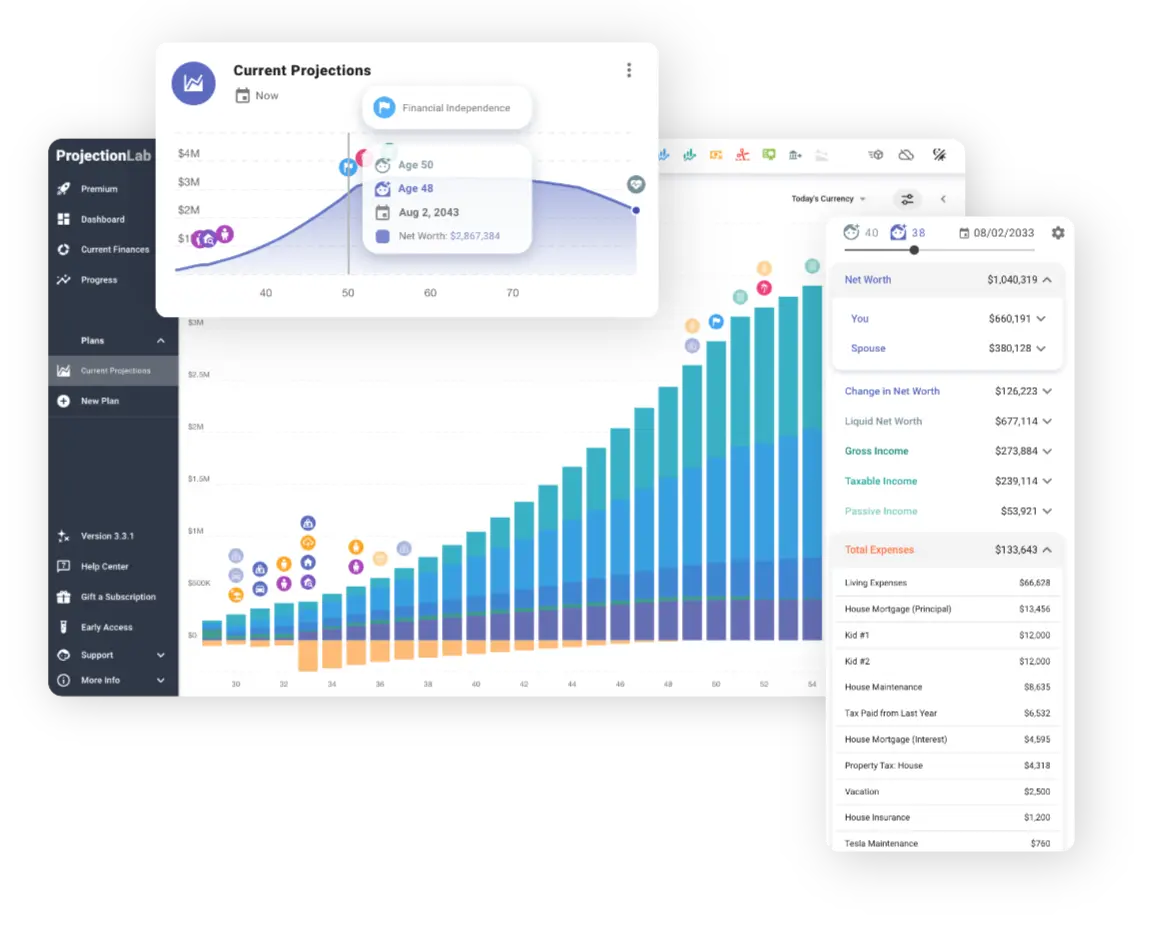

Already optimizing your Social Security? Take your retirement planning to the next level with ProjectionLab, the comprehensive financial modeling platform trusted by serious planners.

- Monte Carlo simulations: Run thousands of market scenarios using 150+ years of historical data to stress-test your plan.

- Advanced modeling: Model complex strategies including Roth conversions, tax-loss harvesting, and dynamic withdrawal rates.

- Professional-grade analytics: Analyze success probabilities, sequence of returns risk, and optimal asset allocation across market cycles.

How Could Congress Fix Social Security?

There are multiple mechanisms by which Congress could conceivably fix the Social Security deficit, which would have less of an impact than the worst case scenario. What will ultimately happen is unknown. Some of the ideas that have been proposed include:

- Increase the payroll tax which funds the program

- Raise the ages at which benefits begin

- Change the method by which inflation adjustments are made to a more slowly rising value

- Change the bend points or ratios for the PIA formula

- Reduce the number of years from which benefits are calculated

- Reduce the spousal benefit

- Invest a percentage of the fund in equities

Will Social Security Go Away Completely?

It is unlikely that the program will go away entirely, due to its popularity. What approach will be taken is unknown — it is up to Congress to decide how to address the issue. It is likely that some combination of the above solutions will be used.

Regardless of what happens with the trust fund, understanding your current benefits is still valuable. Use the SSA.tools calculator to see your projected benefits based on your actual earnings record.

Related Guides

- Primary Insurance Amount (PIA) — How your benefit amount is calculated using the bendpoint formula

- Earnings Cap — The income limit that funds Social Security through payroll taxes

- Work Credits — The 40 credits you need to qualify for retirement benefits

- Maximum Benefit — The highest monthly benefit you could receive today