State Taxes on Social Security Benefits

Published: 2/15/2026

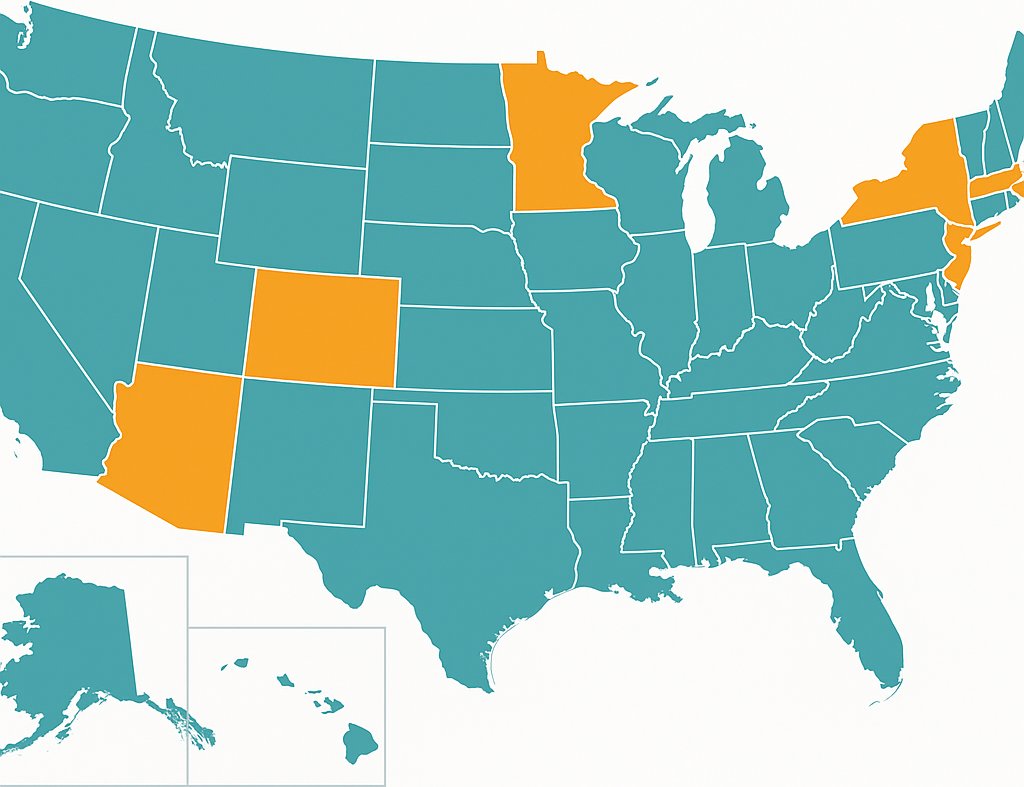

When planning for retirement, most people focus on federal taxes on their Social Security benefits. But depending on where you live, your state may also take a bite. The good news: the vast majority of states do not tax Social Security income. The even better news: the list of states that do tax benefits keeps shrinking.

Key Takeaways

- 42 states + D.C. do not tax Social Security benefits at all

- Only 8 states tax Social Security benefits in 2026

- Most taxing states offer generous exemptions based on age or income

- The trend is clear: states are eliminating their Social Security taxes (down from 13 states in 2020)

- State taxes are separate from federal taxes on benefits

The 8 States That Tax Social Security in 2026

The following states still tax Social Security benefits in some form. However, each offers exemptions or deductions that reduce or eliminate the tax for many retirees.

| State | Key Exemption | Who Pays |

|---|---|---|

| Colorado | Fully exempt at age 65+ | Ages 55-64 above AGI threshold; under 55 generally ineligible |

| Connecticut | Exempt below $75K / $100K AGI | Higher-income filers |

| Minnesota | Exemption phases out above thresholds | Higher-income filers |

| Montana | $5,500+ deduction for 65+ (inflation-adjusted) | Most filers with higher incomes |

| New Mexico | Exempt below $100K / $150K AGI | Higher-income filers |

| Rhode Island | Exempt at FRA with income limits | Higher-income or early filers |

| Utah | Credit below $54K / $90K | Higher-income filers |

| Vermont | Exempt below $55K / $70K AGI | Higher-income filers |

Colorado

Colorado offers a full exemption for retirees age 65 and older. For those age 55-64, benefits are also fully exempt if AGI is below $75,000 (single) or $95,000 (joint); above those thresholds, the deduction is capped at $20,000. Taxpayers under age 55 are generally not eligible for the Social Security subtraction. This makes Colorado one of the most generous taxing states, since the vast majority of Social Security recipients are over 65 and pay nothing.

Connecticut

Connecticut exempts Social Security benefits for single filers with federal AGI below $75,000 and joint filers below $100,000. Above those thresholds, up to 25% of benefits may be taxed. Connecticut has been gradually increasing these thresholds to exempt more retirees.

Minnesota

Minnesota offers a Social Security subtraction that phases out at higher incomes. The phase-out thresholds are adjusted annually for inflation; for 2025, they begin at approximately $84,490 for single filers and $108,320 for joint filers (2026 amounts have not yet been published). Below these thresholds, benefits can be fully or partially exempt. Minnesota's subtraction is tied to the federal taxable amount, so you only pay state tax on the portion already taxable federally.

Montana

Montana allows a deduction of up to $5,500+ (inflation-adjusted annually) for Social Security and other retirement income for taxpayers age 65 and older. The deduction is reduced for higher-income filers based on AGI. Montana uses the federal taxable amount as the starting point, so only benefits that are taxable federally are subject to state tax.

New Mexico

New Mexico exempts Social Security benefits for single filers with AGI below $100,000 and joint filers below $150,000. Above those thresholds, benefits are taxed as regular income. This generous threshold means the majority of New Mexico retirees pay no state tax on their Social Security.

Rhode Island

Rhode Island exempts Social Security benefits for filers who have reached full retirement age (typically 66 to 67, depending on birth year) and whose federal AGI is below $107,000 for single filers or $133,750 for joint filers. Filers who have not reached full retirement age, or who exceed the income limits, may owe state tax on benefits.

Utah

Utah offers a nonrefundable tax credit that offsets the tax on Social Security benefits. The credit is available to single filers with a modified AGI below $54,000 and joint filers below $90,000. The credit phases out above those thresholds. For filers below the income limits, the credit effectively eliminates the state tax on benefits.

Vermont

Vermont provides a full exemption for single filers with AGI below $55,000 and joint filers below $70,000. Above those thresholds, a partial exemption applies that phases out at higher incomes. Vermont has been steadily increasing its exemption thresholds in recent years.

SSA.tools

Free Calculator

SSA.tools Free Calculator

See how this applies to your benefits. Use the free SSA.tools calculator with your actual earnings record for personalized results.

- Copy & paste: Import your earnings record directly from SSA.gov in seconds.

- What-if scenarios: Explore how different filing ages and future earnings affect your benefit.

- 100% private: Your data never leaves your browser — nothing is stored or transmitted.

Recent Changes: States Eliminating Social Security Taxes

The trend is unmistakable: states are dropping their taxes on Social Security benefits. Here are the most recent changes:

| State | Last Year Taxed |

|---|---|

| West Virginia | 2025 (exempt starting 2026) |

| Nebraska | 2024 (exempt starting 2025) |

| Missouri | 2023 (exempt starting 2024) |

| Kansas | 2023 (fully exempt starting 2024) |

In 2020, thirteen states taxed Social Security benefits. By 2026, that number has dropped to just eight. This trend reflects growing recognition that taxing retirement benefits places a disproportionate burden on fixed-income seniors.

States That Do Not Tax Social Security

The following 42 states and Washington, D.C. do not tax Social Security benefits. Some of these states have no income tax at all, while others specifically exempt Social Security from taxation.

- Alabama

- Alaska *

- Arizona

- Arkansas

- California

- Delaware

- Florida *

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Mississippi

- Missouri

- Nebraska

- Nevada *

- New Hampshire *

- New Jersey

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Carolina

- South Dakota *

- Tennessee *

- Texas *

- Virginia

- Washington *

- Washington, D.C.

- West Virginia

- Wisconsin

- Wyoming *

* No state income tax

Interaction with Federal Taxes

State and federal taxation of Social Security are completely independent. At the federal level, up to 85% of your benefits may be taxable, depending on your "provisional income" (AGI + tax-exempt interest + half of your Social Security benefits). The federal thresholds have not changed since 1993.

Living in a state that doesn't tax Social Security does not affect your federal tax obligation, and vice versa. For a full explanation of the federal calculation, see our Federal Taxation of Social Security Benefits guide.

Planning Strategies

Consider State Taxes When Choosing Where to Retire

If you are deciding where to retire, state tax treatment of Social Security is one factor to consider. Moving from a taxing state to a non-taxing state can save hundreds or thousands of dollars per year. However, don't let Social Security tax be the only factor; also consider overall state income tax rates, property taxes, sales taxes, and cost of living.

Manage Your Income to Stay Below Exemption Thresholds

If you live in a state with income-based exemptions, keeping your AGI below the threshold can eliminate your state tax on Social Security. Strategies include timing IRA withdrawals, spreading Roth conversions across multiple years, and harvesting capital losses to offset gains.

Coordinate Roth Conversions

Roth IRA distributions are not included in AGI. Converting traditional IRA funds to a Roth before retirement increases your income now but can help keep your AGI below exemption thresholds in retirement. This is especially valuable in states like Connecticut, New Mexico, and Vermont with clear AGI cutoffs.

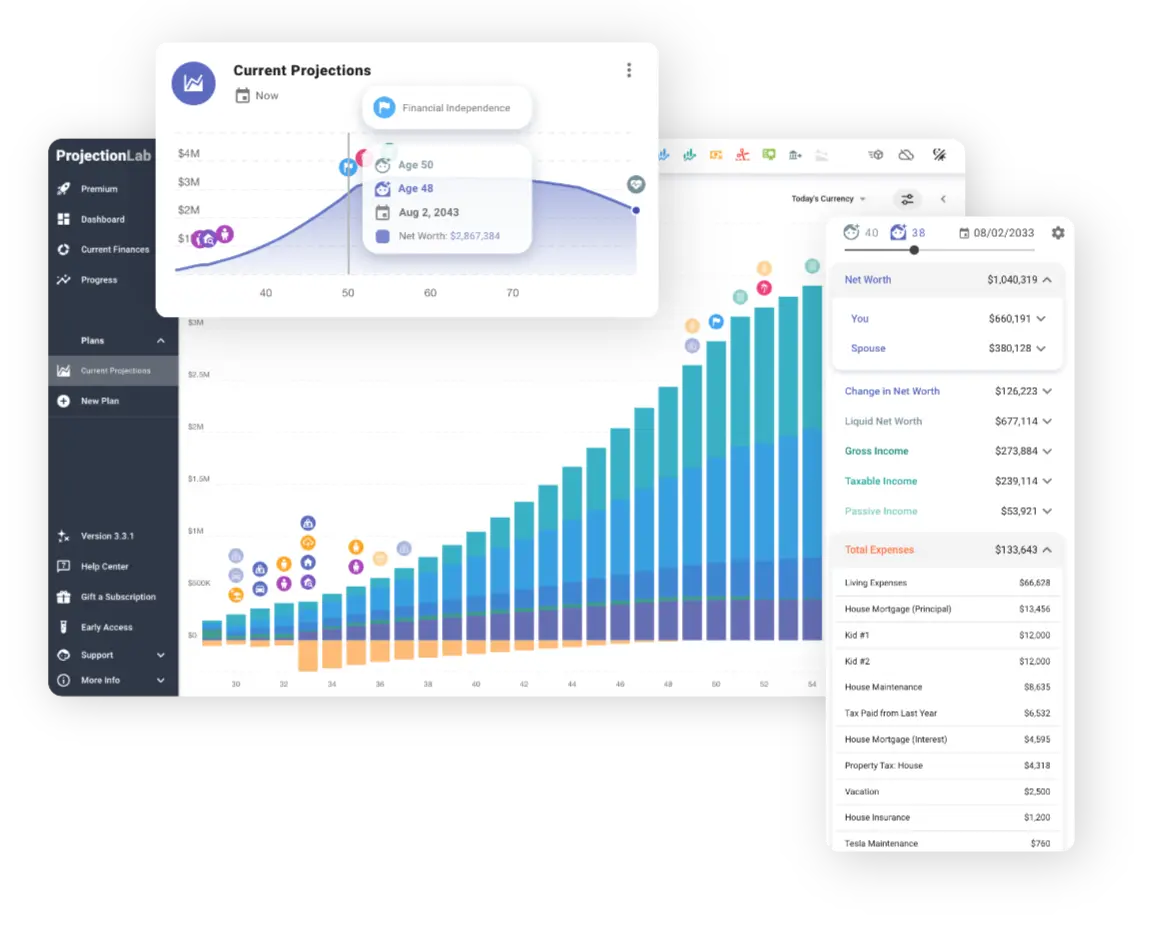

ProjectionLab

Sponsor

ProjectionLab Sponsor

Already optimizing your Social Security? Take your retirement planning to the next level with ProjectionLab, the comprehensive financial modeling platform trusted by serious planners.

- Monte Carlo simulations: Run thousands of market scenarios using 150+ years of historical data to stress-test your plan.

- Advanced modeling: Model complex strategies including Roth conversions, tax-loss harvesting, and dynamic withdrawal rates.

- Professional-grade analytics: Analyze success probabilities, sequence of returns risk, and optimal asset allocation across market cycles.

Frequently Asked Questions

How many states tax Social Security benefits?

As of 2026, only 8 states tax Social Security benefits: Colorado, Connecticut, Minnesota, Montana, New Mexico, Rhode Island, Utah, and Vermont. The remaining 42 states and Washington, D.C. do not tax Social Security benefits at all.

Will my Social Security benefits be taxed if I move to a different state?

Your state tax on Social Security depends on where you live, not where you earned your benefits. If you move from a state that taxes Social Security to one that doesn't, you will no longer owe state tax on your benefits. Your federal tax obligations remain the same regardless of which state you live in.

Are states eliminating their taxes on Social Security benefits?

Yes, there is a clear trend of states eliminating Social Security taxes. West Virginia stopped taxing benefits in 2026, Nebraska in 2025, and Missouri in 2024. The number of states taxing benefits has dropped from 13 in 2020 to just 8 in 2026.

Do I have to pay both state and federal taxes on Social Security?

Potentially, yes. Federal taxation of Social Security is separate from state taxation. Up to 85% of your benefits may be federally taxable depending on your provisional income. If you also live in one of the 8 states that tax benefits, you may owe state income tax as well, though most of these states offer exemptions or deductions that reduce or eliminate the state tax for lower-income retirees.

Does my state tax Social Security the same way the federal government does?

No. Each state that taxes Social Security has its own rules, thresholds, and exemptions that are different from the federal formula. Some states use your federal AGI, others use state-specific income measures. The exemption thresholds and deduction amounts vary widely between states.

Can I reduce my state taxes on Social Security by managing my income?

Yes. In states with income-based exemptions, keeping your adjusted gross income below the exemption threshold can eliminate your state tax on Social Security benefits. Strategies include timing Roth conversions, managing capital gains, and coordinating retirement account withdrawals. Consult a tax professional for advice specific to your state and situation.

Learn More

For a detailed explanation of how Social Security benefits are taxed at the federal level, see our Federal Taxation of Social Security Benefits guide. For information about the new senior tax deduction, see our Senior Tax Deduction guide.

Use the SSA.tools calculator to estimate your Social Security benefits based on your earnings history.