Social Security Benefits for Divorced Spouses

Published: 1/18/2026

Can I collect Social Security from my ex-husband or ex-wife? Yes, you may be entitled to divorced spouse benefits worth up to 50% of your ex-spouse's benefit amount, even if they've remarried and even without their knowledge or consent.

Divorce doesn't necessarily end your connection to Social Security benefits earned during your marriage. If you were married for at least 10 years, you may have valuable benefit options that many people don't know about.

Key Takeaways

- You can receive up to 50% of your ex-spouse's full retirement benefit

- Your marriage must have lasted at least 10 years

- You must be currently unmarried (with some exceptions)

- Your ex-spouse's benefit is not reduced by your claim

- Your ex-spouse is not notified when you claim

- If your ex dies, you may receive up to 100% as a survivor benefit

Eligibility Requirements for Divorced Spouse Benefits

To qualify for Social Security benefits based on your ex-spouse's work record, you must meet all of the following requirements:

The Five Requirements

- 10-Year Marriage: Your marriage must have lasted at least 10 years. This is measured from the date of marriage to the date the divorce was finalized, even if you were separated before then.

- Currently Unmarried: You must be currently unmarried. If you remarried but that marriage ended (through divorce, annulment, or death), you may regain eligibility.

- Age 62 or Older: You must be at least 62 years old to claim divorced spouse retirement benefits.

- Ex-Spouse Eligible: Your ex-spouse must be entitled to Social Security retirement or disability benefits. They don't need to have filed yet (see below).

- Your Own Benefit Is Lower: If you're entitled to your own Social Security benefit, it must be less than what you'd receive as a divorced spouse. Social Security automatically pays you the higher amount.

The 10-Year Marriage Rule Explained

The 10-year marriage requirement is the most common reason people don't qualify for divorced spouse benefits. Social Security counts from your wedding date to the date your divorce was legally finalized.

Periods of separation do not count against you. What matters is the legal duration of the marriage, not how long you lived together.

Multiple Marriages

If you were married multiple times, each lasting at least 10 years, you may have options. You can only receive benefits based on one ex-spouse's record at a time, but you can choose the one that provides the highest benefit.

How Divorced Spouse Benefits Are Calculated

The divorced spouse benefit is based on your ex-spouse's Primary Insurance Amount (PIA), which is the benefit they would receive at their Normal Retirement Age (NRA). The maximum divorced spouse benefit is 50% of your ex-spouse's PIA, which you'd receive if you claim at your own full retirement age. Claiming earlier reduces your benefit:

| Your Claiming Age | Percentage of Maximum |

|---|---|

| 62 | 32.5% - 35%* |

| 63 | 35% - 37.5%* |

| 64 | 37.5% - 41.7%* |

| 65 | 41.7% - 45.8%* |

| 66 | 45.8% - 50%* |

| 67 (NRA for those born 1960+) | 50% |

*Exact percentage depends on your birth year and corresponding Normal Retirement Age.

Example Calculation

Example: Alex's Divorced Spouse Benefit

Alex was married to Chris for 15 years before divorcing. Chris's PIA is $2,400 per month. Alex's own PIA based on their work history is $900 per month.

- Alex's divorced spouse benefit at NRA: $2,400 × 50% = $1,200

- Alex's own benefit at NRA: $900

- Alex receives: $1,200 (the higher amount)

If Alex claims at 62, their divorced spouse benefit would be reduced to approximately $840 per month (assuming a 30% reduction for early claiming).

ProjectionLab

Sponsor

ProjectionLab Sponsor

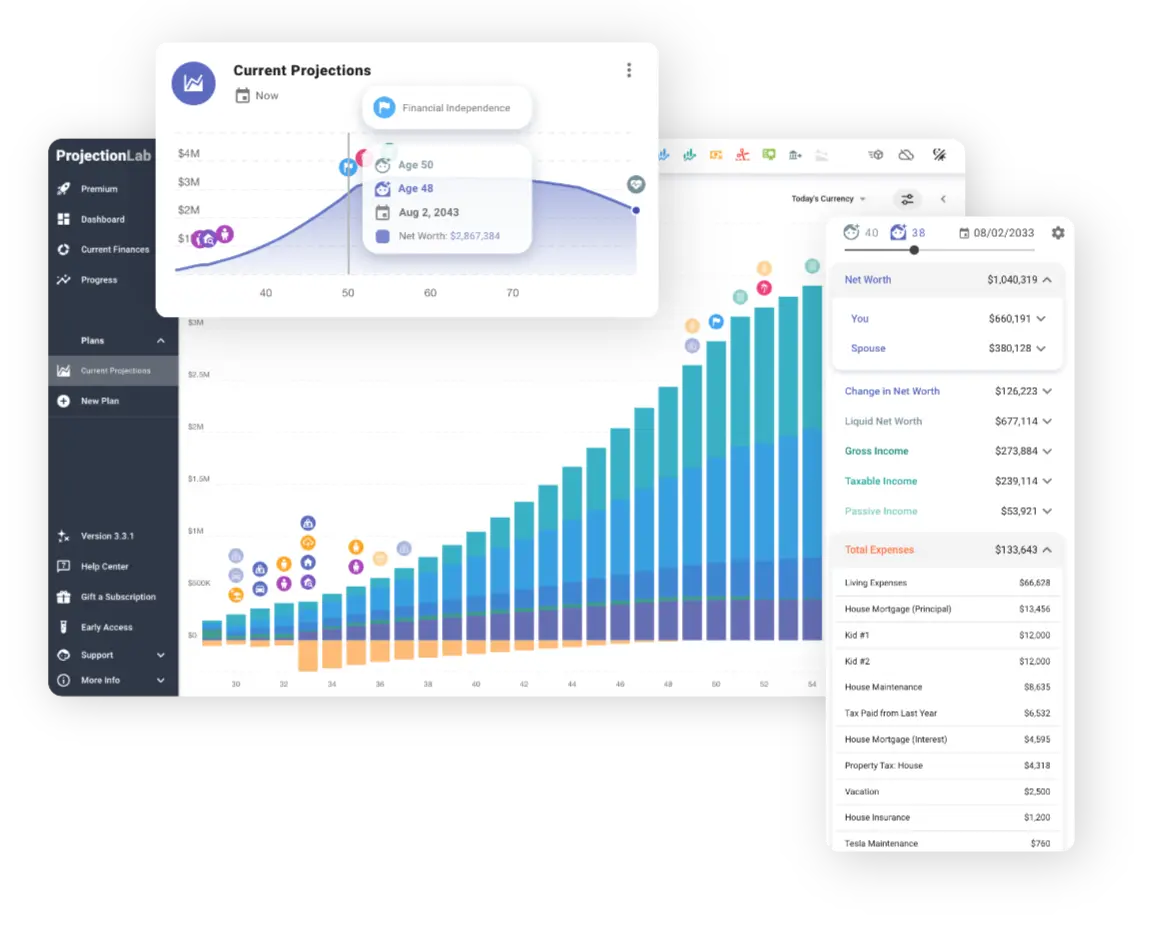

Already optimizing your Social Security? Take your retirement planning to the next level with ProjectionLab, the comprehensive financial modeling platform trusted by serious planners.

- Monte Carlo simulations: Run thousands of market scenarios using 150+ years of historical data to stress-test your plan.

- Advanced modeling: Model complex strategies including Roth conversions, tax-loss harvesting, and dynamic withdrawal rates.

- Professional-grade analytics: Analyze success probabilities, sequence of returns risk, and optimal asset allocation across market cycles.

Does My Ex-Spouse Know If I Claim Benefits?

No. The Social Security Administration maintains strict confidentiality. When you apply for divorced spouse benefits:

- Your ex-spouse is not contacted or notified

- Your ex-spouse does not need to consent or sign anything

- Your ex-spouse's benefit amount is completely unaffected

- Your ex-spouse cannot block or prevent your claim

The divorced spouse benefit is paid from Social Security's general trust fund, not deducted from your ex-spouse's payment. Their monthly check remains exactly the same whether you claim or not.

What If My Ex-Spouse Hasn't Filed Yet?

Under the independently entitled divorced spouse rule, you can claim benefits even if your ex-spouse hasn't filed for their own benefits, as long as:

- You have been divorced for at least 2 years

- Your ex-spouse is at least 62 years old

- Your ex-spouse is entitled to benefits (has enough work credits)

This rule was created specifically to prevent an ex-spouse from deliberately delaying their filing to block their former spouse's benefits. Once the 2-year waiting period passes, you can file independently.

What If My Ex-Spouse Remarried?

Your ex-spouse's current marital status has no effect on your eligibility for divorced spouse benefits. You can claim even if they:

- Have remarried once or multiple times

- Have a current spouse also claiming spousal benefits

- Have other ex-spouses from 10+ year marriages claiming benefits

Social Security allows unlimited divorced spouse beneficiaries on one worker's record. Each person's benefit is calculated independently, and none affects the others.

Can I Claim If I Remarried?

Generally, remarriage ends your eligibility for divorced spouse benefits. However, there are important exceptions:

- Marriage ended: If your subsequent marriage ended through divorce, annulment, or your spouse's death, you may regain eligibility for benefits from your first ex-spouse (assuming the 10-year requirement was met).

- Survivor benefits after age 60: If you remarry after age 60 (or age 50 if disabled), you can still receive divorced spouse survivor benefits if your ex-spouse has died.

Divorced Spouse Survivor Benefits

If your ex-spouse dies, you may be eligible for survivor benefits, which are significantly more generous than divorced spouse retirement benefits. The maximum survivor benefit is 100% of your ex-spouse's benefit, compared to 50% while they were alive.

Survivor Benefit Requirements

- Marriage lasted at least 10 years

- You are at least 60 years old (or 50 if disabled)

- You are unmarried, OR you remarried after age 60 (50 if disabled)

Survivor benefits can be claimed as early as age 60, though claiming before your full retirement age results in a reduction. At age 60, you'd receive approximately 71.5% of the full survivor benefit.

Divorced Spouse Benefits vs. Your Own Benefits

If you're entitled to both your own retirement benefit and a divorced spouse benefit, Social Security effectively pays you the higher amount. Technically, you receive your own benefit first, and if the divorced spouse benefit is higher, you receive an additional amount to bring you up to that level.

You cannot receive both benefits in full. It's always the higher of the two.

When Your Own Benefit Might Be Higher

- You had substantial earnings throughout your career

- Your ex-spouse had relatively low lifetime earnings

- You delay claiming past your full retirement age (your own benefit grows, but divorced spouse benefit doesn't)

How to Apply for Divorced Spouse Benefits

To apply for divorced spouse benefits, you'll need:

- Your ex-spouse's Social Security number (or enough information for SSA to locate their record)

- Your marriage certificate

- Your final divorce decree

- Proof of your age (birth certificate or passport)

You can apply:

- Online: Through ssa.gov (limited for divorced spouse claims)

- By phone: Call 1-800-772-1213

- In person: At your local Social Security office

Divorced spouse benefit applications often require a phone or in-person appointment, as the online system may not fully support these claims.

Frequently Asked Questions

Can I collect Social Security from my ex-spouse?

Yes, if your marriage lasted at least 10 years, you are currently unmarried (or remarried after age 60), you are at least 62 years old, and your ex-spouse is entitled to Social Security benefits. You can receive up to 50% of your ex-spouse's benefit amount.

Does my ex-spouse need to know I'm claiming benefits on their record?

No. The Social Security Administration does not notify your ex-spouse when you claim divorced spouse benefits. Your claim is completely confidential and has no effect on their benefit amount.

Will claiming divorced spouse benefits reduce my ex's Social Security?

No. Your divorced spouse benefit is paid from Social Security's general funds, not from your ex-spouse's benefit. Their monthly payment remains exactly the same regardless of whether you claim.

What if my ex-spouse remarried?

Your ex-spouse's marital status does not affect your eligibility. You can still claim divorced spouse benefits even if your ex has remarried. Their new spouse can also claim spousal benefits independently.

Can I receive divorced spouse benefits if I remarried?

Generally no, unless your subsequent marriage ended through death, divorce, or annulment. However, if you remarry after age 60 (or age 50 if disabled), you can still receive divorced spouse survivor benefits.

What is the 10-year marriage rule for Social Security?

To qualify for divorced spouse benefits, your marriage must have lasted at least 10 years. This is measured from the date of marriage to the date the divorce was finalized. Even one day short of 10 years disqualifies you.

Can I collect divorced spouse benefits if my ex hasn't filed yet?

Yes, under the independently entitled divorced spouse rule. If you have been divorced for at least 2 years and your ex-spouse is at least 62, you can claim benefits even if they haven't filed. This prevents an ex from deliberately delaying to block your benefits.

What happens to my divorced spouse benefits if my ex-spouse dies?

You may be eligible for divorced spouse survivor benefits, which can be up to 100% of your ex-spouse's benefit amount (compared to 50% while they were alive). You must have been married for at least 10 years and be at least 60 years old (or 50 if disabled).

Calculate Your Benefits

Understanding your divorced spouse benefit options starts with knowing the numbers. Use the SSA.tools calculator to estimate your own Social Security benefit based on your earnings record. If you know your ex-spouse's approximate benefit amount, you can compare to see whether your own benefit or the divorced spouse benefit would be higher.

For a deeper understanding of how benefits are calculated, see our guides on Primary Insurance Amount (PIA) and Spousal Benefits and Filing Dates.