Social Security Survivor Benefits

Published: 1/19/2026

How much can a surviving spouse receive? Survivor benefits can be up to 100% of your deceased spouse's benefit amount, making them significantly more valuable than the 50% maximum for spousal benefits while your spouse was alive.

Social Security survivor benefits provide crucial financial support for widows, widowers, children, and in some cases dependent parents. Understanding the rules can help you maximize your benefits during a difficult time.

Key Takeaways

- Survivor benefits can be up to 100% of the deceased's benefit (vs. 50% for spousal benefits)

- Widows and widowers can claim as early as age 60 (age 50 if disabled)

- Remarriage before age 60 generally ends eligibility (with exceptions)

- Children may qualify until age 18 (19 if still in high school)

- You may be able to switch between survivor and your own benefits strategically

- Survivor benefits have a different retirement age schedule than regular retirement benefits

Who Qualifies for Survivor Benefits?

Several categories of family members may be eligible for survivor benefits when a worker dies:

Eligible Beneficiaries

Widows and Widowers

- Age 60 or older (or age 50 if disabled)

- Marriage lasted at least 9 months (with exceptions)

- Currently unmarried, or remarried after age 60

Divorced Surviving Spouses

- Marriage lasted at least 10 years

- Age 60 or older (or age 50 if disabled)

- Currently unmarried, or remarried after age 60

- See our divorced spouse benefits guide for more details

Surviving Children

- Unmarried and under age 18

- OR age 18-19 and still attending high school full-time

- OR any age if disabled before age 22

- Can receive up to 75% of deceased's benefit

Dependent Parents (Age 62+)

- Must have received at least half their support from the deceased

- One parent: up to 82.5% of deceased's benefit

- Two parents: up to 75% each

The 9-Month Marriage Requirement

To qualify for survivor benefits as a widow or widower, your marriage generally must have lasted at least 9 months before your spouse's death. However, there are important exceptions:

- Death was accidental

- Death occurred in the line of military duty

- You and your spouse were previously married, divorced, and then remarried

- You are the parent of the worker's child

How Survivor Benefits Are Calculated

The survivor benefit amount depends on what your spouse was receiving (or would have received) and when you claim. The calculation varies based on whether your spouse had already filed for benefits.

Calculation Scenarios

The amount you receive depends on your spouse's filing status at death:

| Scenario | Survivor Benefit Basis |

|---|---|

| Spouse was receiving benefits | The greater of: their benefit at death, or 82.5% of their PIA |

| Spouse died after NRA without filing | What they would have received if they'd filed at death |

| Spouse died before NRA without filing | 100% of their PIA |

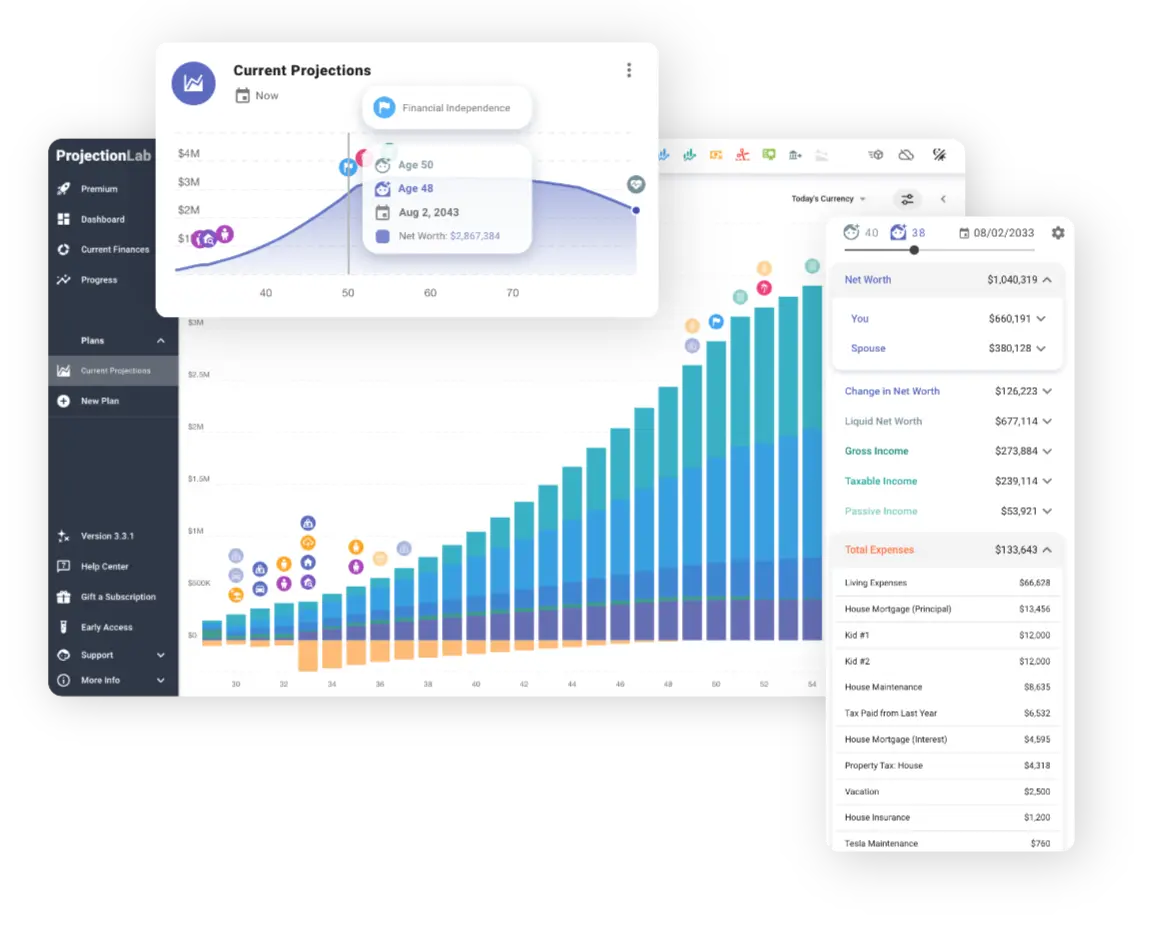

ProjectionLab

Sponsor

ProjectionLab Sponsor

Already optimizing your Social Security? Take your retirement planning to the next level with ProjectionLab, the comprehensive financial modeling platform trusted by serious planners.

- Monte Carlo simulations: Run thousands of market scenarios using 150+ years of historical data to stress-test your plan.

- Advanced modeling: Model complex strategies including Roth conversions, tax-loss harvesting, and dynamic withdrawal rates.

- Professional-grade analytics: Analyze success probabilities, sequence of returns risk, and optimal asset allocation across market cycles.

Survivor Normal Retirement Age

Survivor benefits have their own full retirement age schedule, which is different from the regular retirement age. The survivor NRA determines when you can receive 100% of the survivor benefit without reduction.

| Year of Birth | Survivor Full Retirement Age |

|---|---|

| 1939 or earlier | 65 |

| 1940 | 65 and 2 months |

| 1941 | 65 and 4 months |

| 1942 | 65 and 6 months |

| 1943 | 65 and 8 months |

| 1944 | 65 and 10 months |

| 1945-1956 | 66 |

| 1957 | 66 and 2 months |

| 1958 | 66 and 4 months |

| 1959 | 66 and 6 months |

| 1960 | 66 and 8 months |

| 1961 | 66 and 10 months |

| 1962 or later | 67 |

Compare this to the regular retirement NRA, which reaches 67 for those born in 1960 or later. The survivor NRA schedule transitions more gradually.

Early Claiming Reductions

You can claim survivor benefits as early as age 60 (or 50 if disabled), but claiming before your survivor NRA reduces your benefit:

| Claiming Age | Approximate Percentage of Full Benefit |

|---|---|

| 60 | 71.5% |

| 61 | 75.6% |

| 62 | 79.6% |

| 63 | 83.7% |

| 64 | 87.8% |

| 65 | 91.8% |

| 66 | 95.9% |

| 67 (Survivor NRA for 1962+) | 100% |

*Exact percentages vary based on your birth year and corresponding survivor NRA. The reduction is approximately 28.5% spread evenly over 84 months from age 60 to 67.

Strategic Claiming: Switching Between Benefits

One of the most valuable aspects of survivor benefits is the ability to claim one type of benefit first and switch later. This is different from spousal benefits, where such strategies are more limited.

Example: Maria's Switching Strategy

Maria is 60 when her husband dies. Her own PIA is $1,800, and her full survivor benefit would be $2,400.

Option A: Survivor First, Own Later

- Age 60: Claim survivor benefit at 71.5% = $2,400 × 71.5% = $1,716/month

- Age 70: Switch to own benefit with delayed credits = $1,800 × 124% = $2,232/month

Option B: Own First, Survivor Later

- Age 62: Claim own benefit at 70% = $1,800 × 70% = $1,260/month

- Age 67: Switch to full survivor benefit = $2,400/month

The best choice depends on Maria's health, financial needs, and life expectancy. Option A provides more money initially; Option B provides a higher ultimate benefit.

When Each Strategy Makes Sense

- Claim survivor first: If your own benefit at 70 would be higher than your full survivor benefit, claim survivor early and let your own benefit grow.

- Claim own first: If the full survivor benefit is higher than your own benefit at 70, claim your reduced own benefit early and switch to the full survivor benefit at your survivor NRA.

Remarriage and Survivor Benefits

Remarriage can affect your eligibility for survivor benefits, but the rules are flexible:

Remarriage Rules

Remarriage Before Age 60

If you remarry before age 60 (or 50 if disabled), you generally cannot receive survivor benefits from your deceased spouse while you remain married. However, if that marriage ends, you may regain eligibility.

Remarriage at Age 60 or Later

If you remarry at age 60 or later (50 if disabled), you can still receive survivor benefits from your deceased spouse. This is a significant exception that preserves your benefit eligibility.

Work Credits Required

For survivors to receive benefits, the deceased worker must have earned enough work credits. The number required depends on the worker's age at death:

- Under age 28: Generally 6 credits needed

- Age 28 and older: Generally 1 credit for each year after age 21, up to 40 credits maximum

There's also a special rule: if a worker dies leaving a spouse with children, benefits may be payable if the worker had at least 6 credits in the 3 years before death, regardless of total credits earned.

The Lump Sum Death Benefit

In addition to monthly survivor benefits, Social Security pays a one-time lump sum death benefit of $255 to:

- A surviving spouse who was living with the deceased, OR

- A surviving spouse eligible for benefits in the month of death, OR

- An eligible child (if no eligible spouse)

You must apply for this benefit within two years of the worker's death. Note: This amount has not been increased since 1954.

Government Pension Offset (GPO) - Now Repealed

Prior to January 2025, the Government Pension Offset (GPO) reduced survivor benefits for those receiving government pensions from work not covered by Social Security. The Social Security Fairness Act of 2025 repealed this provision.

Government workers (teachers, firefighters, state employees, etc.) now receive their full survivor benefits without reduction. See our WEP guide for more information about these historic changes.

Common Misconceptions

Reality: Widows and widowers can claim survivor benefits as early as age 60. If disabled, you can claim as early as age 50. This is different from retirement and spousal benefits, which require age 62.

Reality: That's spousal benefits you're thinking of. Survivor benefits can be up to 100% of your deceased spouse's benefit amount, not 50%.

Reality: You can switch between survivor benefits and your own retirement benefit. Many people strategically claim one first and switch to the other later to maximize lifetime benefits.

Reality: If you remarried at age 60 or later (50 if disabled), you can still receive survivor benefits from your deceased spouse. Even if you remarried earlier, you may regain eligibility if that marriage ends.

Reality: Survivor benefits do NOT earn delayed retirement credits. Your maximum survivor benefit is at your survivor NRA. Unlike your own retirement benefit, there's no advantage to waiting past that age.

Frequently Asked Questions

How much is the Social Security survivor benefit?

The survivor benefit can be up to 100% of the deceased spouse's benefit amount. If you claim at your full survivor retirement age (66-67 depending on birth year), you receive the full amount. Claiming as early as age 60 reduces the benefit to approximately 71.5%. This is significantly higher than spousal benefits, which max out at 50%.

Can I collect survivor benefits at age 60?

Yes. Widows and widowers can claim survivor benefits as early as age 60. However, claiming at 60 reduces your benefit to approximately 71.5% of the full amount. If you're disabled, you may claim as early as age 50 with a larger reduction. Waiting until your full survivor retirement age (66-67) provides the maximum survivor benefit.

Can I receive both my own Social Security and survivor benefits?

You cannot receive both benefits simultaneously in full. However, you can claim one benefit first and switch to the other later. For example, claim reduced survivor benefits at 60 while your own benefit grows, then switch to your own benefit at 70 for a higher amount. Social Security pays you the higher of the two.

Can I remarry and still collect survivor benefits?

If you remarry before age 60 (or age 50 if disabled), you generally cannot receive survivor benefits on your deceased spouse's record while married. However, if you remarry at age 60 or later, you can still receive survivor benefits. If the subsequent marriage ends, you may also regain eligibility.

What is the difference between survivor benefits and spousal benefits?

Spousal benefits are for living couples and max out at 50% of your spouse's benefit. Survivor benefits are for widows and widowers and can be up to 100% of the deceased's benefit. Survivor benefits can start at age 60 (vs. 62 for spousal), and have a different full retirement age schedule.

How long do you have to be married to collect survivor benefits?

You must have been married for at least 9 months before your spouse's death to qualify for survivor benefits. Exceptions exist for accidental death, death in military service, or if you were previously married to the same person. For divorced surviving spouses, the marriage must have lasted at least 10 years.

Do survivor benefits increase if I wait past full retirement age?

No. Unlike your own retirement benefit, survivor benefits do not earn delayed retirement credits. Your maximum survivor benefit is reached at your full survivor retirement age (66-67 depending on birth year). Waiting past that age provides no additional increase to survivor benefits.

How to Apply for Survivor Benefits

You can apply for survivor benefits:

- By phone: Call Social Security at 1-800-772-1213

- In person: Visit your local Social Security office

- Online: Limited online options available at ssa.gov

You'll need:

- Death certificate

- Your Social Security number and the deceased's

- Your birth certificate

- Marriage certificate (for widow/widower claims)

- Divorce decree (for divorced surviving spouse claims)

- Dependent children's birth certificates and Social Security numbers

Calculate Your Benefits

Understanding your options starts with knowing your own benefit amount. Use the SSA.tools calculator to estimate your retirement benefit based on your earnings history.

For more information on related topics, see our guides on divorced spouse benefits, spousal benefits and filing dates, and Normal Retirement Age.